What to expect in 2024

It is the time of the year when we reflect, celebrate and look forward.

Following a tougher 2022, equity and fixed income both returned positively in 2023. Technology companies (the “magnificent seven” in particular), that are now a big part of our lifestyle, contributed significantly to equity market returns. Central banks, such as the Federal Reserve, the Bank of Canada and the European Central Bank, were raising interest rates to fight inflation. As a result, fixed income markets were very volatile and spent most of the year in negative territory. Geopolitical tensions remain intense with ongoing war in Russia and Ukraine and a new conflict in the Middle East.

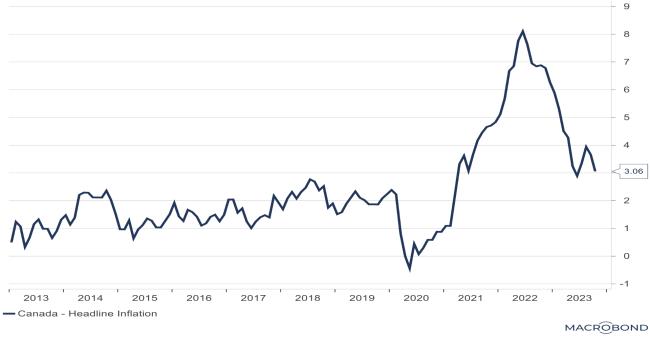

As you would expect, not all events start in January and end in December. Some of the trends that will likely play out in 2024 are already taking shape as we head into the last quarter of 2023. In Canada, we have seen a slowdown in our economy and a substantial decrease in property sales. Consumer Price Index rose 3.1% on a year-over-year basis in October. While it is still above the 2% central bank target, it is substantially lower compared to a reading of 8.1% at the peak in June 2022 and 3.8% in September. (chart below) In the U.S., inflation is also cooling but the economy and job markets remain very strong. Canadians in general are more sensitive to high interest rates as we, on average, carry more debt and our mortgages are shorter term, hence resetting to higher rates sooner.

Canada - Headline Inflation

It is widely expected that the rate hike cycle is now completed in most countries, including Canada and the U.S. Since investors and central bankers anticipate neutral rates to be 2-3%, current rates are extremely restrictive and are probably meant only for the short term. Investors paid attention to all economic data and central bankers’ speeches as they gauged the rate direction in 2023. While economic data are objective, reflecting economic activities, central bankers’ comments are subjective. We expect investors to care less about what central banks say in 2024 and more about the economy itself as it is a consensus rates have peaked. As we said earlier, the Canadian economy is already in a slowdown and causing prices to fall. It is likely to get worse in the coming months if rates remain at current levels. Households that carry a mortgage, effectively the majority of the population, are refinancing at much higher interest rates, thus significantly increasing their payments. For example, payment on a mortgage of $500,000 would increase by $850 a month as rates have risen from 3% to 6%. This puts pressure on Canadians to spend less on everything else. We anticipate the Bank of Canada to cut rates in 2024 to avoid a severe economic downturn. This could come as soon as the first quarter and the rate cuts could total as much as 150 basis points in 2024. The yield curve appears to be capturing the cuts properly with 2-year Government of Canada bonds priced at 4.07% (as at Dec 5, 2023), 5-year at 3.46% and 10-year at 3.37%, versus overnight rates at 5%.

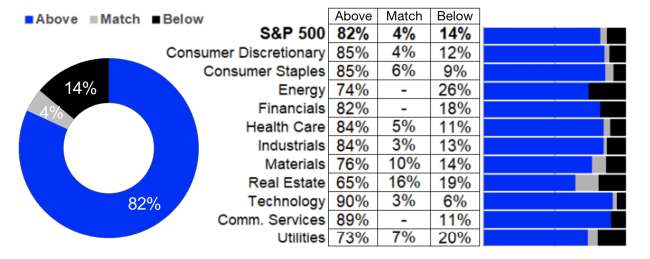

Things are better in the U.S. as homeowners enjoy low rates locked in for longer terms as mortgages are typically a 30-year term. This means higher rates have had no impact on people who have bought houses. Inflation is cooling, driven by lower import prices (partly due to a strong USD) and, of course, easing of supply constraints experienced during COVID. The U.S. economy is also resilient for other reasons. It dominates in technology development, especially in smart phones, internet search engines, software and artificial intelligence. Companies like Apple have actually been benefiting from higher rates as they earn higher interest. (Apple earned USD $984 million in interest income during the fiscal quarter ended in September.) The last round of corporate earnings confirmed that the U.S. is not near a recession, with 82% of companies’ earnings coming in above expectations (chart below). Americans can probably afford to keep interest rates higher for longer.

Source: LSEG I/B/E/S

Elsewhere, we expect problems in the real estate sector in China to persist and weigh on the economy. It will take years to unwind the overbuild situations in property and manufacturing. In the meantime, it is deflationary for those that buy products from China. Japan is a bright spot, with low interest rates and solid growth. The yen has been penalized as the Bank of Japan was not following its peers in hiking rates. As the rate hiking cycle ends, we expect the yen to strengthen versus both the Canadian dollar and the U.S. dollar.

We remain constructive in the technology sector as earnings are stable and new technology such as generative AI and high-speed computing are driving growth independent of the economy. Since the U.S. dominates in the tech space, we anticipate the U.S. economy to remain resilient despite high rates. The first rate cut in the U.S. may be closer to the end of the second quarter, rather than the beginning as we would expect for Canada. As a result, we prefer to have more U.S. dollar exposure and U.S. bonds rather than Canadian dollar and Canadian bonds. We are also overweight on the tech sector.

The low-risk trade for 2024 is likely to be short duration corporate bonds. From a term perspective, they earn a premium over long-dated bonds as the yield curve is inverted. They also earn additional credit premium, and we expect risk to be minimal in the near term.

The next best thing is probably generative AI through semiconductors, data centers and software. We are at the beginning of a revolutionary trend, and those sectors will see a steep increase in demand and very high profit margins for a while. The last time we had a mega-trend like this was the internet and smart phones over 20 years ago and the personal computer 50 years ago. It is important we capture this trend and not ignore it. However, it will have its fair share of volatility.

Overall, the bond markets should generate a return very close to the yield, which is 4%. Those who look for more because of falling rates will likely be disappointed as the rally already began in November of this year as expectations were reset. Equity will do fine, assuming interest rates fall and global economies slow moderately but not meaningfully. The equity markets will be divergent, rewarding stock picking, as there will be winners and losers from the revolutionary change we discussed above.

Lastly, China could surprise on the upside if stimulating efforts are effective and investors return to China after being concerned for both economic and political reasons. Speaking of politics, we also have a U.S. election in November of 2024. It is probably too early to call who will be the next U.S. President and what implications that will have.

On behalf of myself and my colleagues, we want to wish you a joyful and healthy holiday season and all the best in 2024.

Summary

As we approach the end of 2023, many trends are set to persist into 2024. On the negative side, geopolitical tensions, high inflation, high interest rates, and problems in the real estate sector are likely to continue into the new year. On the other hand, AI and tech companies should continue to support equity markets, while a strong U.S. dollar, resilient job market, and the possibility of rate cuts offer optimism. A few unknowns, such as the outcome of the upcoming U.S. presidential election and China’s possible economic rebound, are also key areas to watch.

About the Author

Alfred has more than 18 years of experience specializing in portfolio design, asset allocation, manager and fund selection, and risk management. While at CI Global Asset Management, Alfred has brought unique ideas and processes to the management of the team’s multi-asset strategies, including a mean-reversion currency management strategy, the concept of investing in concentrated and benchmark-agnostic portfolios, and a new approach to risk management. In addition to the Chartered Financial Analyst (CFA) designation, Alfred holds an MBA from the York University Schulich School of Business, and is a member of the CFA Institute and the Toronto CFA Society.

IMPORTANT DISCLAIMERS

The opinions expressed in the communication are solely those of the author(s) and are not to be used or construed as investment advice or as an endorsement or recommendation of any entity or security discussed. This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what CI Global Asset Management and the portfolio manager believe to be reasonable assumptions, neither CI Global Asset Management nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document. CI Global Asset Management is a registered business name of CI Investments Inc. ©CI Investments Inc. 2023. All rights reserved.