Now is your time to live life and have fun

Let us make life planning easy for you.

You love your children…..and your grandchildren

Our planning incorporates helping your family and the next generations.

Life is complicated, so is Wealth

We think about your financial planning 365 days a year, so you don’t have to.

Helping your community be a better place

Our planning includes philanthropy and magnifying your gifts to the charities you love and support.

Special Report - The Top 6 Critical Questions to ask a Financial Planner

Our Guiding Values

Purpose

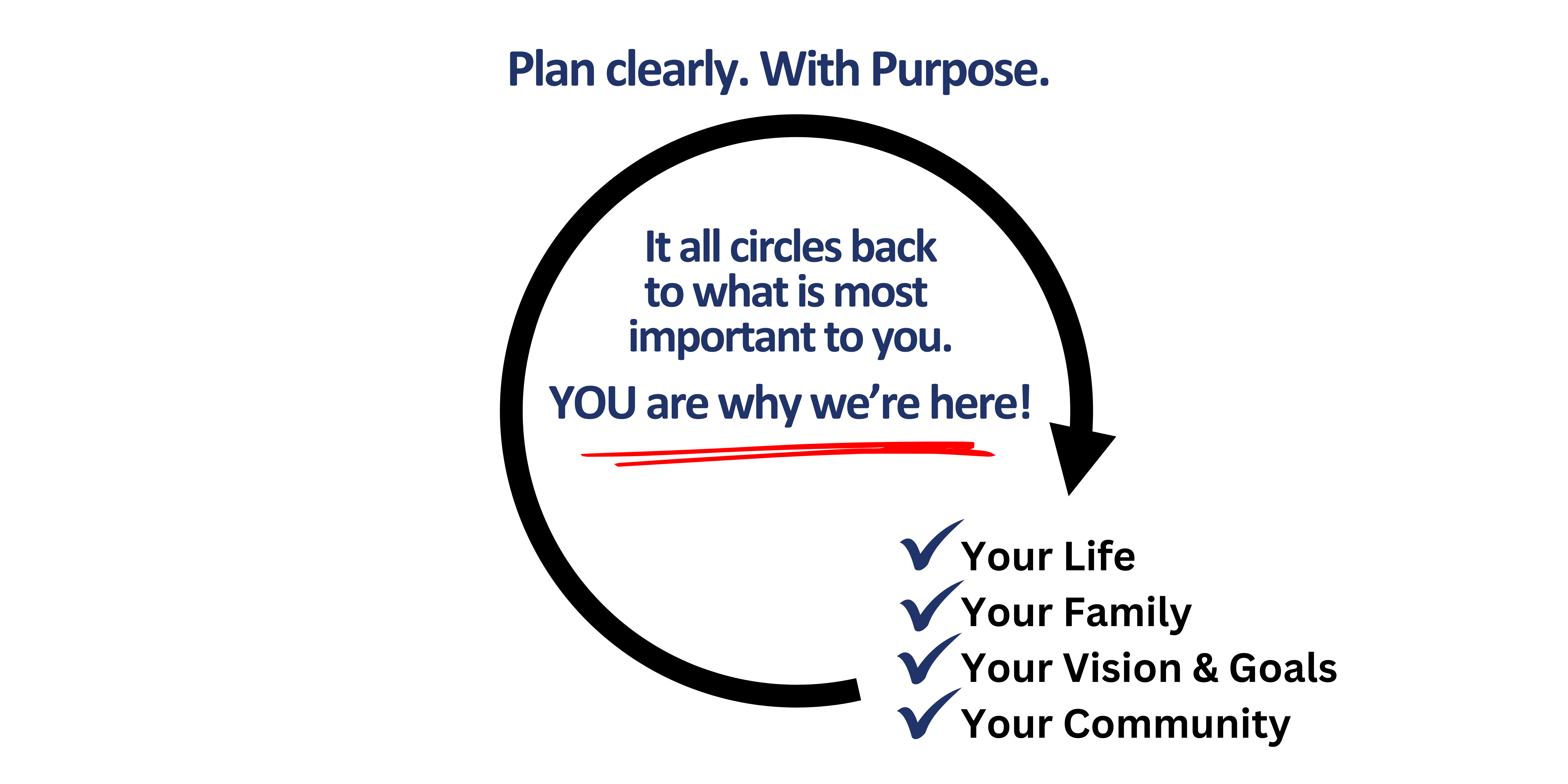

Let us align your financial plan with your values and the reason you are here.

Family

Family is everything, so let us incorporate them into your planning.

Community

Sharing in your success with the less fortunate and improving your community is important to you. Planning for this is one of our favourite things.

Clarity

Planning with clarity illuminates where you are going and makes decision making easy.

Focus on what matters and we will take care of the rest!

Special Report - Create Your Family’s Philanthropic Plan: 6 Key Steps to Consider

The Most Commonly Asked Questions:

Am I making smart decisions about my money?

How do I help my children now and in the future?

How do I reduce my taxes?

How do I give to charities now and in my will?

When life happens, who's there to guide me?

Featured In

Is Cash Making a Comeback?

Morningstar.ca I 2024-03-05

Morningstar’s journalist, Ashley Redmond, recently contacted Rich. As a Senior Financial Planner and Financial Expert, she sought his insights regarding a recent study that uncovered an unexpected increase in cash transactions. Read the full article here: Is Cash Making a Comeback?